Blockchain & Crypto

Blockchain and Crypto projects widely emerged and innovation in the space explodes

Introducing Smart Contracts

Ethereum, introduced in 2015, revolutionized the blockchain space by introducing smart contracts. Smart contracts are self-executing contracts where the terms of the agreement are directly written into code. These contracts automatically enforce and execute the agreed-upon terms when certain conditions are met, eliminating the need for intermediaries. This innovation opened up a new world of possibilities beyond Bitcoin’s simple transactions, making blockchain technology more versatile and powerful.

With smart contracts, Ethereum enabled the creation of decentralized applications (dApps) that operate on the blockchain. These applications range from decentralized finance (DeFi) platforms, which offer financial services without traditional banks, to non-fungible tokens (NFTs) for unique digital assets. Smart contracts are also paving the way for the emergence of Web 3.0, the next iteration of the internet, characterized by decentralized networks and applications that give users more control over their data and digital identities. The introduction of smart contracts marked a significant evolution in blockchain technology, expanding its potential and applications in numerous industries.

Introducing Smart Contracts

Ethereum, introduced in 2015, revolutionized the blockchain space by introducing smart contracts. Smart contracts are self-executing contracts where the terms of the agreement are directly written into code. These contracts automatically enforce and execute the agreed-upon terms when certain conditions are met, eliminating the need for intermediaries. This innovation opened up a new world of possibilities beyond Bitcoin’s simple transactions, making blockchain technology more versatile and powerful.

With smart contracts, Ethereum enabled the creation of decentralized applications (dApps) that operate on the blockchain. These applications range from decentralized finance (DeFi) platforms, which offer financial services without traditional banks, to non-fungible tokens (NFTs) for unique digital assets. Smart contracts are also paving the way for the emergence of Web 3.0, the next iteration of the internet, characterized by decentralized networks and applications that give users more control over their data and digital identities. The introduction of smart contracts marked a significant evolution in blockchain technology, expanding its potential and applications in numerous industries.

Consensus Mechanisms

Consensus mechanisms are protocols that ensure all participants in a blockchain network agree on the validity of transactions. The most well-known mechanisms are Proof of Work (PoW) and Proof of Stake (PoS). PoW, used by Bitcoin, requires miners to solve complex mathematical problems to validate transactions, which consumes significant energy. PoS, used by Ethereum 2.0, selects validators based on the number of coins they hold and are willing to “stake” as collateral, which is more energy-efficient.

These mechanisms have different trade-offs. PoW is highly secure and decentralized but energy-intensive and less scalable. PoS, on the other hand, offers better scalability and lower energy consumption but can lead to centralization if a small number of participants hold most of the stake. Different consensus mechanisms are better suited for different use cases due to these trade-offs. For instance, PoW might be preferred for highly secure, decentralized networks, while PoS could be better for applications requiring higher transaction throughput. As blockchain technology evolves, new consensus mechanisms like Delegated Proof of Stake (DPoS) and Byzantine Fault Tolerance (BFT) are emerging, each with unique advantages and trade-offs.

Consensus Mechanisms

Consensus mechanisms are protocols that ensure all participants in a blockchain network agree on the validity of transactions. The most well-known mechanisms are Proof of Work (PoW) and Proof of Stake (PoS). PoW, used by Bitcoin, requires miners to solve complex mathematical problems to validate transactions, which consumes significant energy. PoS, used by Ethereum 2.0, selects validators based on the number of coins they hold and are willing to “stake” as collateral, which is more energy-efficient.

These mechanisms have different trade-offs. PoW is highly secure and decentralized but energy-intensive and less scalable. PoS, on the other hand, offers better scalability and lower energy consumption but can lead to centralization if a small number of participants hold most of the stake. Different consensus mechanisms are better suited for different use cases due to these trade-offs. For instance, PoW might be preferred for highly secure, decentralized networks, while PoS could be better for applications requiring higher transaction throughput. As blockchain technology evolves, new consensus mechanisms like Delegated Proof of Stake (DPoS) and Byzantine Fault Tolerance (BFT) are emerging, each with unique advantages and trade-offs.

Non Fungible Tokens

Non-fungible tokens (NFTs) are unique digital assets verified using blockchain technology. Unlike fungible tokens such as Bitcoin or Ethereum, which are interchangeable and identical in value, NFTs are indivisible and unique. This distinction makes NFTs ideal for representing ownership of digital art, collectibles, real estate, and other unique items. NFTs became popular around 2020 and 2021, with high-profile sales and celebrity endorsements driving significant attention to the space.

To understand the difference, consider fungible tokens like dollar bills: it doesn’t matter which specific dollar bill you have, as all have the same value. In contrast, NFTs are like entrance tickets to a concert, where each ticket is unique and grants access to a specific event. The “Bored Ape Yacht Club” is a prime example of NFTs’ rise and volatility. These digital collectibles were initially sold for a few hundred dollars but skyrocketed to values in the hundreds of thousands. However, the market’s speculative nature led to significant price drops, illustrating how quickly NFT popularity can rise and fall, causing incredible price decreases.

Non Fungible Tokens

Non-fungible tokens (NFTs) are unique digital assets verified using blockchain technology. Unlike fungible tokens such as Bitcoin or Ethereum, which are interchangeable and identical in value, NFTs are indivisible and unique. This distinction makes NFTs ideal for representing ownership of digital art, collectibles, real estate, and other unique items. NFTs became popular around 2020 and 2021, with high-profile sales and celebrity endorsements driving significant attention to the space.

To understand the difference, consider fungible tokens like dollar bills: it doesn’t matter which specific dollar bill you have, as all have the same value. In contrast, NFTs are like entrance tickets to a concert, where each ticket is unique and grants access to a specific event. The “Bored Ape Yacht Club” is a prime example of NFTs’ rise and volatility. These digital collectibles were initially sold for a few hundred dollars but skyrocketed to values in the hundreds of thousands. However, the market’s speculative nature led to significant price drops, illustrating how quickly NFT popularity can rise and fall, causing incredible price decreases.

Custody Fundamentals

Transacting cryptocurrencies involves the use of public and private keys. The public key is your address on the blockchain, visible to everyone, while the private key is a secret code that grants access to your funds. Losing your private key means losing access to your cryptocurrency, underscoring the importance of secure storage. Wallets often require a “seed phrase,” a series of words that can be used to recover your wallet if lost. If you lose your seed phrase for a non-custodial wallet, you lose access to your crypto permanently.

Cryptocurrency wallets can be custodial or non-custodial. Custodial wallets are managed by third parties, like exchanges, which hold your private keys for you. Non-custodial wallets give you full control over your private keys, enhancing security but also requiring you to manage them responsibly. Wallets can also be software-based, accessible online, or hardware-based (cold storage), which store keys offline and provide superior security against hacking. Choosing the right wallet involves balancing convenience and security based on your needs.

Custody Fundamentals

Transacting cryptocurrencies involves the use of public and private keys. The public key is your address on the blockchain, visible to everyone, while the private key is a secret code that grants access to your funds. Losing your private key means losing access to your cryptocurrency, underscoring the importance of secure storage. Wallets often require a “seed phrase,” a series of words that can be used to recover your wallet if lost. If you lose your seed phrase for a non-custodial wallet, you lose access to your crypto permanently.

Cryptocurrency wallets can be custodial or non-custodial. Custodial wallets are managed by third parties, like exchanges, which hold your private keys for you. Non-custodial wallets give you full control over your private keys, enhancing security but also requiring you to manage them responsibly. Wallets can also be software-based, accessible online, or hardware-based (cold storage), which store keys offline and provide superior security against hacking. Choosing the right wallet involves balancing convenience and security based on your needs.

Trading Fundamentals

Trading cryptocurrencies has become extremely popular, operating 24/7 unlike traditional financial markets. This constant availability allows traders to respond to market changes at any time, offering flexibility and opportunity. However, it also requires vigilance and strategy due to the market’s volatility. We do not invite people to go on and trade cryptocurrencies as it is very risky. However, we understand that people want to trade crypto and aim to provide them with some basic knowledge from which they can start their learning journey.

Trading can be done on Centralized Exchanges (CEX) or Decentralized Exchanges (DEX). CEX, like Binance or Coinbase, are managed by companies that provide user-friendly platforms and liquidity but require users to trust the exchange with their funds. DEX, like Uniswap or SushiSwap, operate without intermediaries, offering greater privacy and control over funds but often at the cost of higher complexity and lower liquidity. Each type of exchange has its own advantages and trade-offs, catering to different preferences and risk appetites of traders. Understanding these differences is crucial for anyone interested in trading cryptocurrencies.

Trading Fundamentals

Trading cryptocurrencies has become extremely popular, operating 24/7 unlike traditional financial markets. This constant availability allows traders to respond to market changes at any time, offering flexibility and opportunity. However, it also requires vigilance and strategy due to the market’s volatility. We do not invite people to go on and trade cryptocurrencies as it is very risky. However, we understand that people want to trade crypto and aim to provide them with some basic knowledge from which they can start their learning journey.

Trading can be done on Centralized Exchanges (CEX) or Decentralized Exchanges (DEX). CEX, like Binance or Coinbase, are managed by companies that provide user-friendly platforms and liquidity but require users to trust the exchange with their funds. DEX, like Uniswap or SushiSwap, operate without intermediaries, offering greater privacy and control over funds but often at the cost of higher complexity and lower liquidity. Each type of exchange has its own advantages and trade-offs, catering to different preferences and risk appetites of traders. Understanding these differences is crucial for anyone interested in trading cryptocurrencies.

Influentials

Vitalik Buterin

Vitalik Buterin is the co-founder of Ethereum, a pioneering blockchain platform that supports smart contracts and decentralized applications. His contributions have been instrumental in advancing the Web3 ecosystem.

Gavin Wood

Gavin Wood is a co-founder of Ethereum and the creator of Polkadot. His work focuses on building interoperable blockchain networks and enhancing Ethereum’s functionality through innovative technology.

Charles Hoskinson

Charles Hoskinson is the co-founder of Ethereum and the founder of Cardano. His work is centered on developing blockchain platforms with a focus on scalability, governance, and sustainability.

Influentials

Vitalik Buterin

Vitalik Buterin is the co-founder of Ethereum, a pioneering blockchain platform that supports smart contracts and decentralized applications. His contributions have been instrumental in advancing the Web3 ecosystem.

Gavin Wood

Gavin Wood is a co-founder of Ethereum and the creator of Polkadot. His work focuses on building interoperable blockchain networks and enhancing Ethereum’s functionality through innovative technology.

Charles Hoskinson

Charles Hoskinson is the co-founder of Ethereum and the founder of Cardano. His work is centered on developing blockchain platforms with a focus on scalability, governance, and sustainability.

Recommended 2 Read

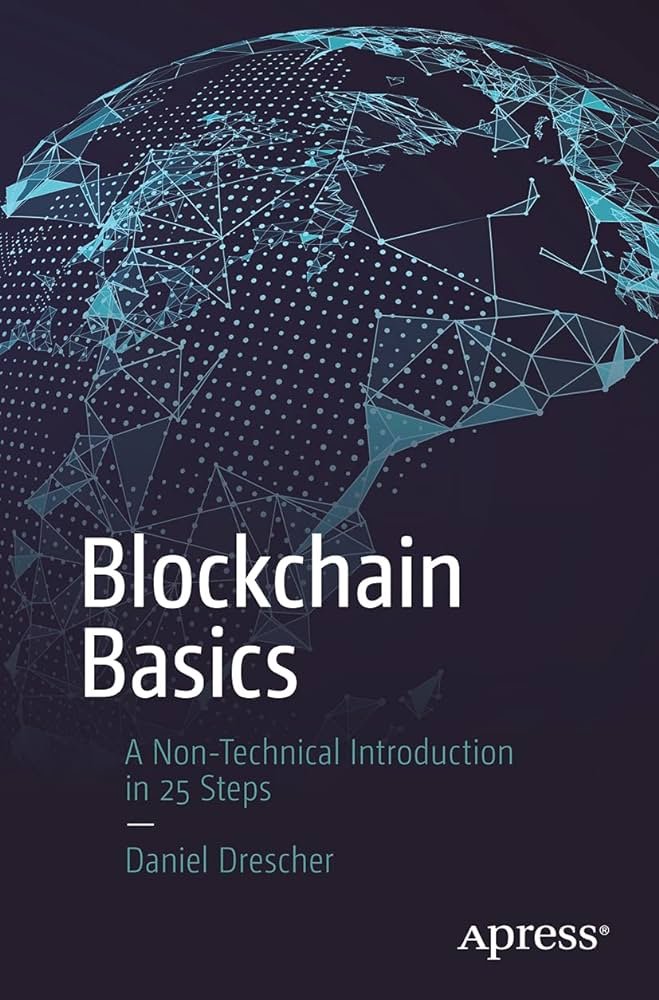

Blockchain Basics

“Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher is a step-by-step guide designed to introduce readers to the fundamental concepts of blockchain technology without requiring any prior technical knowledge. Drescher methodically breaks down the complex ideas behind blockchain into 25 clear and manageable steps, making it accessible to beginners and non-technical readers. The book covers the principles of blockchain, how it works, and its potential applications across various industries. “Blockchain Basics” is an excellent resource for anyone looking to gain a foundational understanding of blockchain, its significance in the digital age, and how it might shape the future of technology and finance.

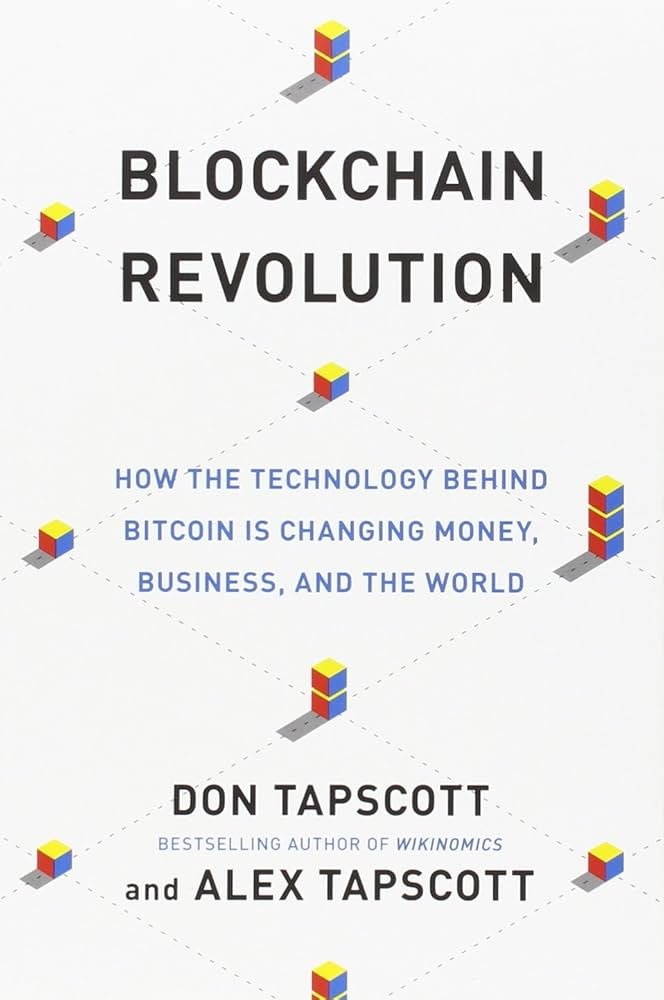

Blockchain Revolution

In “Blockchain Revolution: How the Technology Behind Bitcoin and Other Cryptocurrencies is Changing the World,” authors Don and Alex Tapscott explore the transformative potential of blockchain technology beyond its role in cryptocurrencies. The book examines how blockchain is poised to disrupt various industries, from finance to supply chains, healthcare, and even government. The Tapscotts argue that blockchain represents a fundamental shift in how we structure our economic and social systems, enabling greater transparency, security, and efficiency. Through a series of case studies and expert insights, “Blockchain Revolution” illustrates the far-reaching implications of this technology and its potential to reshape the world as we know it. This book is a must-read for anyone interested in understanding the broader impact of blockchain and how it could revolutionize the way we conduct business and manage information.

Recommended 2 Read

Blockchain Basics

“Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher is a step-by-step guide designed to introduce readers to the fundamental concepts of blockchain technology without requiring any prior technical knowledge. Drescher methodically breaks down the complex ideas behind blockchain into 25 clear and manageable steps, making it accessible to beginners and non-technical readers. The book covers the principles of blockchain, how it works, and its potential applications across various industries. “Blockchain Basics” is an excellent resource for anyone looking to gain a foundational understanding of blockchain, its significance in the digital age, and how it might shape the future of technology and finance.

Blockchain Revolution

In “Blockchain Revolution: How the Technology Behind Bitcoin and Other Cryptocurrencies is Changing the World,” authors Don and Alex Tapscott explore the transformative potential of blockchain technology beyond its role in cryptocurrencies. The book examines how blockchain is poised to disrupt various industries, from finance to supply chains, healthcare, and even government. The Tapscotts argue that blockchain represents a fundamental shift in how we structure our economic and social systems, enabling greater transparency, security, and efficiency. Through a series of case studies and expert insights, “Blockchain Revolution” illustrates the far-reaching implications of this technology and its potential to reshape the world as we know it. This book is a must-read for anyone interested in understanding the broader impact of blockchain and how it could revolutionize the way we conduct business and manage information.

Learn more about Blockchain & Crypto!

Blockchain Tech Fundamentals

Uncover the basic fundamental concepts of the underlying technologies that are present in the blockchain world.

Non Fungible Tokens

Dive deep into Non Fungible Tokens and how it gained a lot of interest over the last couple of years.

Custody & Trading Fundamentals

Discover everything you need to know about the fundamentals of custody and how self-custody can be achieved. And learn about some trading fundamentals.

Learn more about Blockchain & Crypto!

Blockchain Tech Fundamentals

Uncover the basic fundamental concepts of the underlying technologies that are present in the blockchain world.

Non Fungible Tokens

Dive deep into Non Fungible Tokens and how it gained a lot of interest over the last couple of years.

Custody & Trading Fundamentals

Discover everything you need to know about the fundamentals of custody and how self-custody can be achieved. And learn about some trading fundamentals.

Support us in our mission

The best way to support our mission is to ‘Learn and Tell’ about decentralization. To help us improve our website you can buy the recommend books through affiliate links, watch our content on YouTube or donate Bitcoin on our Lightning wallet address. Learn more below!

Contact us!

Any recommendations about our website, or questions about decentralization or the content provided? Do not hesitate to contact us! You can drop us a message on the contact page or drop us an email at: info@r2decentralization.com